360 degree view of your finances, manage subscriptions, know paydays, split bills, share spending, and stay financially in sync—without the awkward talks.

Download Chip In today and turn joint spending into a breeze—so you can focus on what matters, together.

Save, spend & manage money with your partner.

App Features

Full insights into your financial portfolio. Subscription and payday predictions, comprehensive recurring income and expense details. Spending overview by category and frequency. Securely sync daily transactions, split by category, connect partners, pay via Venmo/CashApp, track & reverse payments, free 7‑day trial, cancel anytime.

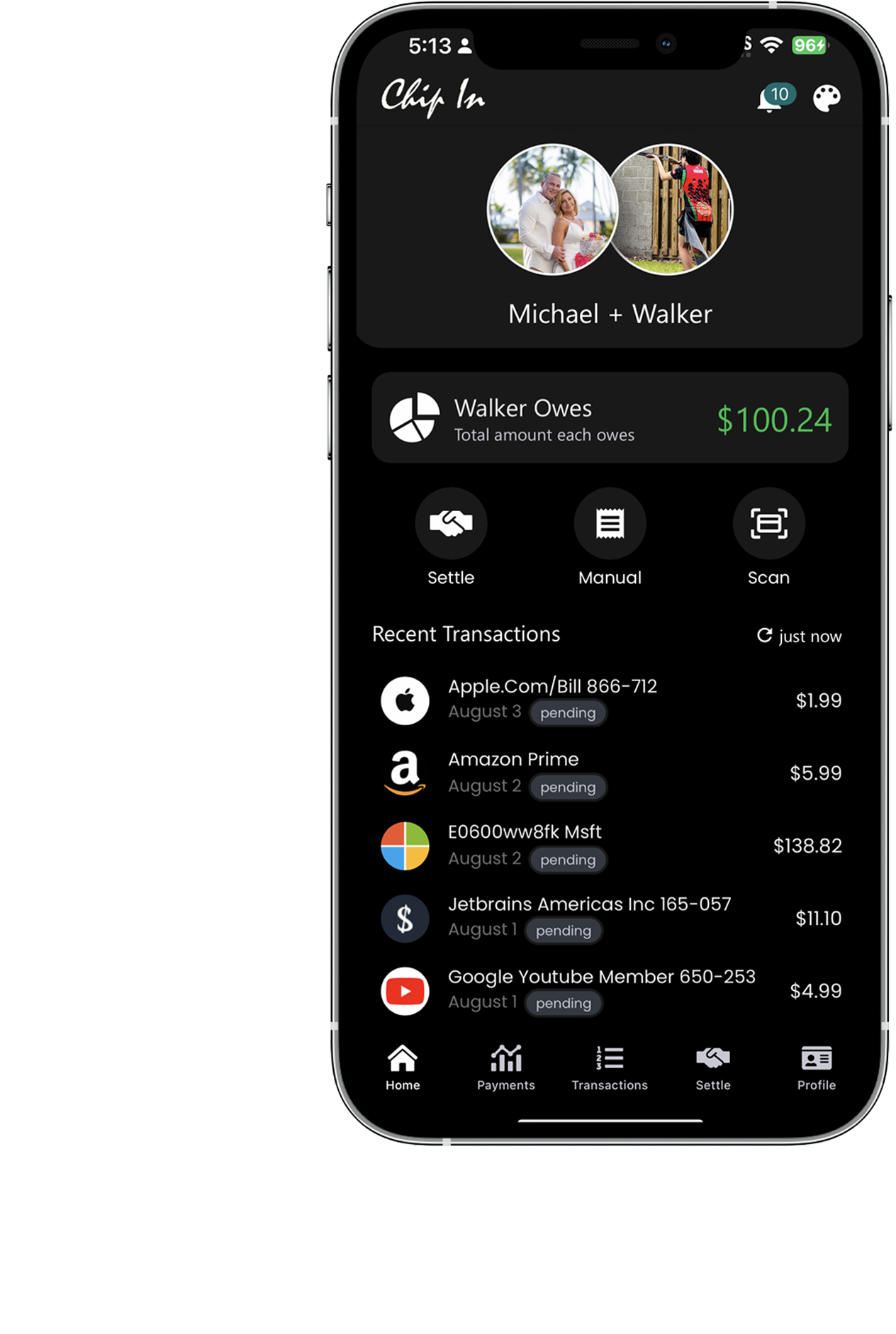

Automatic daily sync

Every purchase from your linked bank or card accounts lands in the app each day, courtesy of secure PLAID financial institution integration.

Bank‑grade security

Zero credential storage, one‑time‑password sign‑up, encrypted cloud architecture, and the latest secure protocols keep your data locked down.

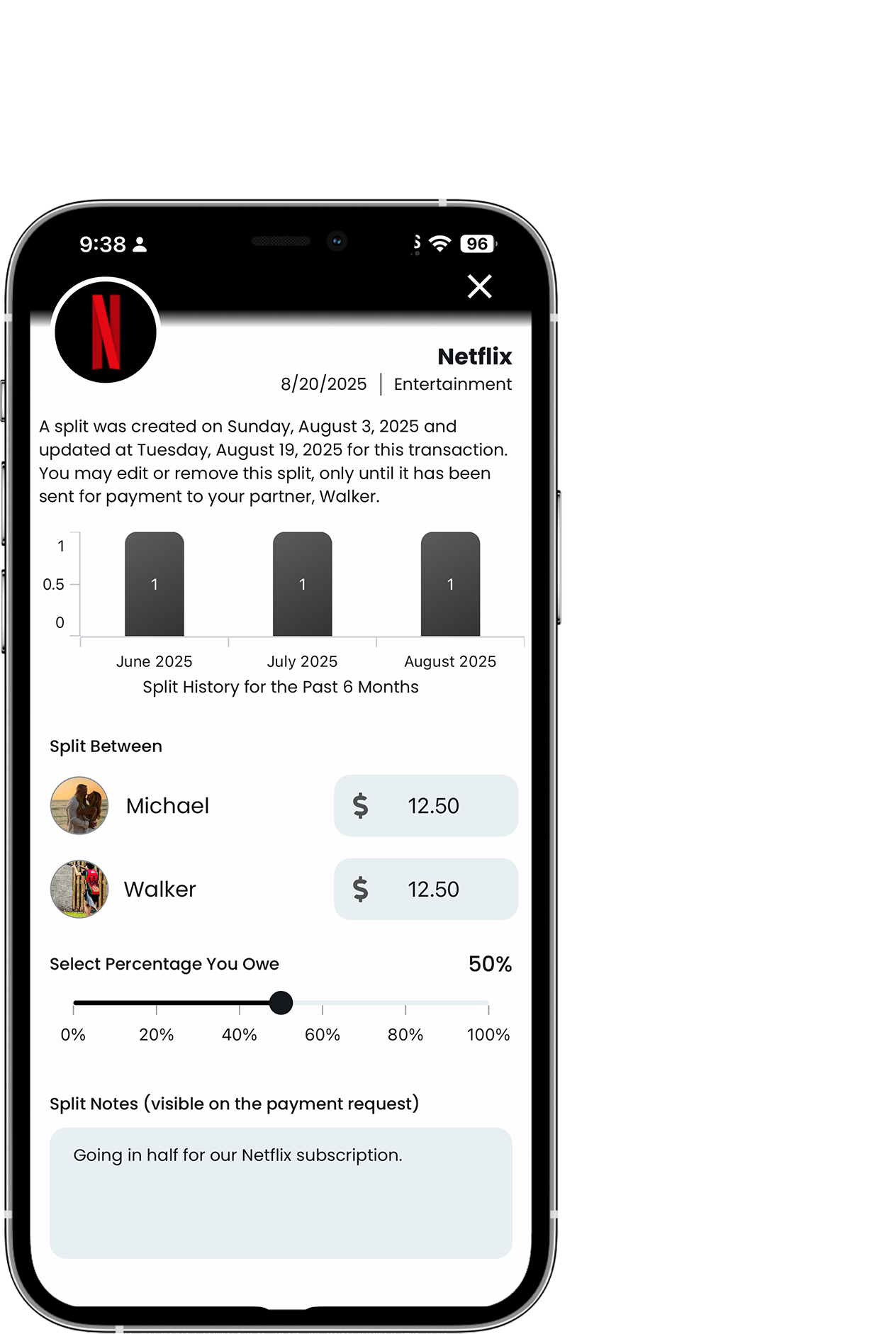

One‑tap splits & category insights

Divide any transaction 50/50 or by custom amounts, then see exactly where shared money goes with effortless category breakdowns.

Instant partner connect

Invite your partner in seconds and start sharing only the transactions you choose; your individual accounts stay completely siloed.

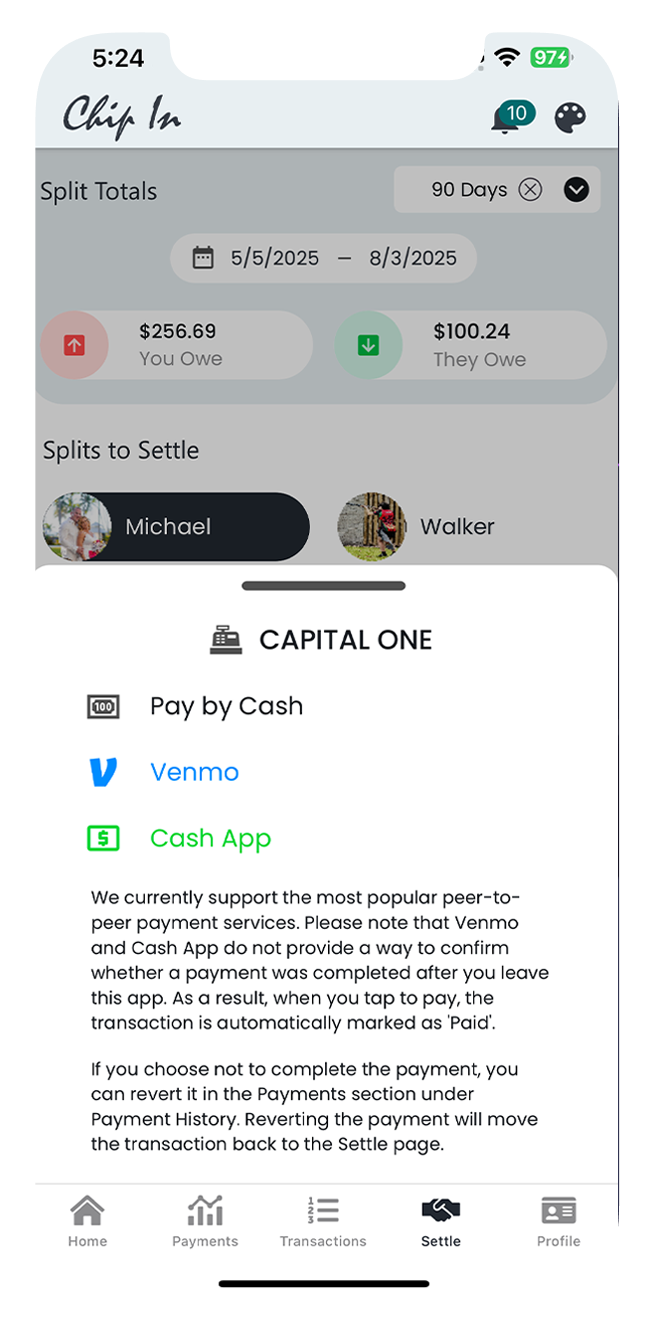

Flexible, reversible payments

Settle up instantly through peer-to-peer payment apps Venmo, Cash App, or other types, such as cash/check payments. Change your mind? Reverse the payment record before money moves.

Fair & flexible pricing

Enjoy a very generous 30‑day free trial, then choose an industry‑leading low monthly or annual plan. Cancel anytime—no phone calls, no chatbots, no hassle.

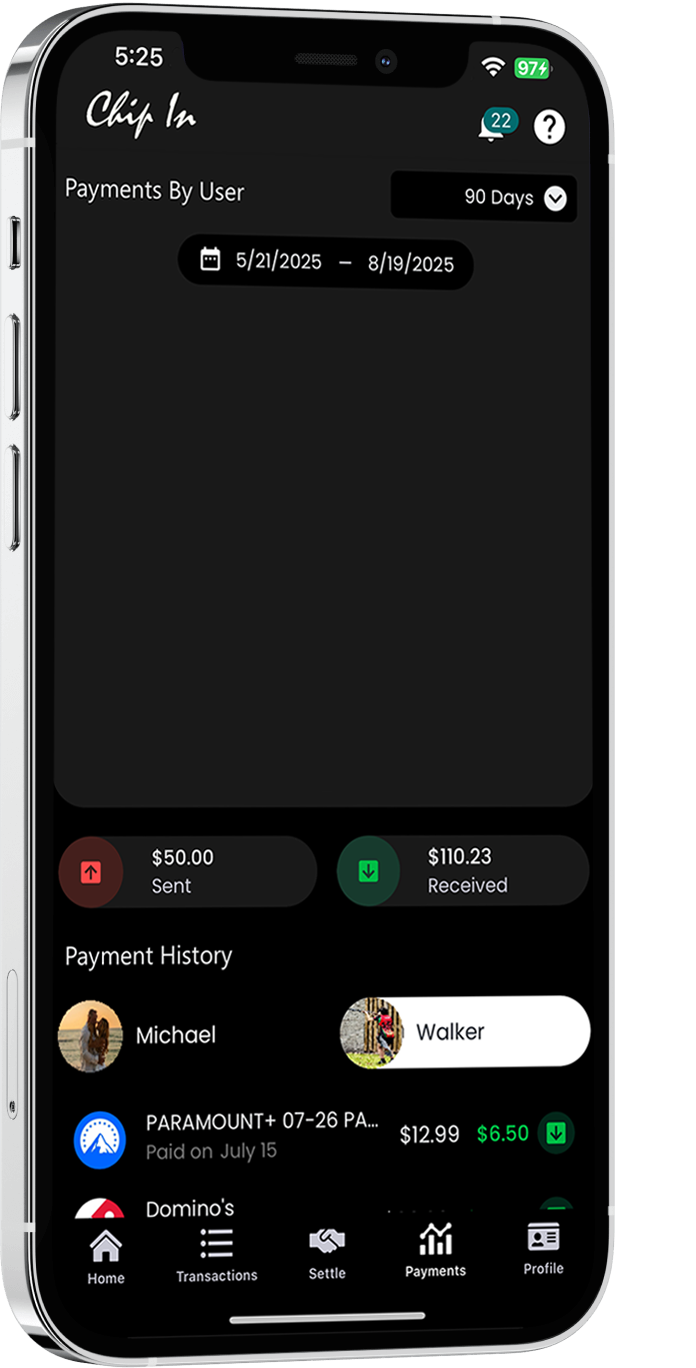

A Look Into The App...

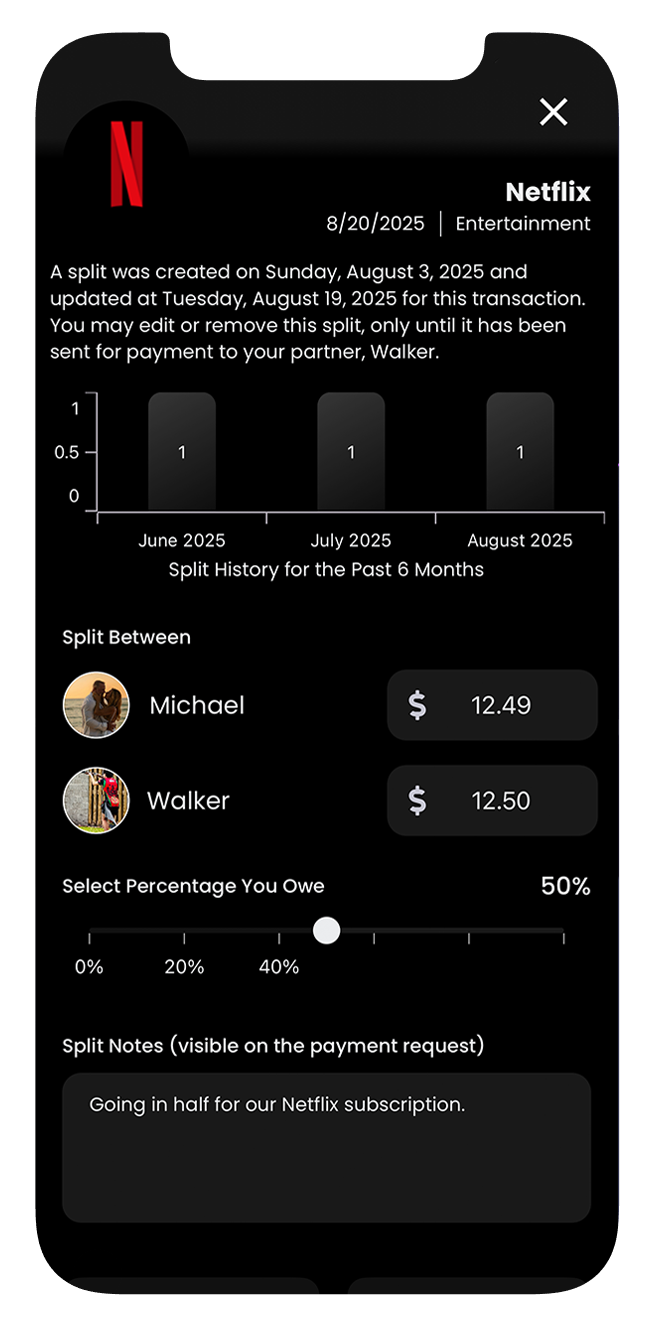

Step 1. One‑tap splits & category insights

Divide any transaction 50/50 or by custom amounts, then see exactly where shared money goes with effortless category breakdowns.

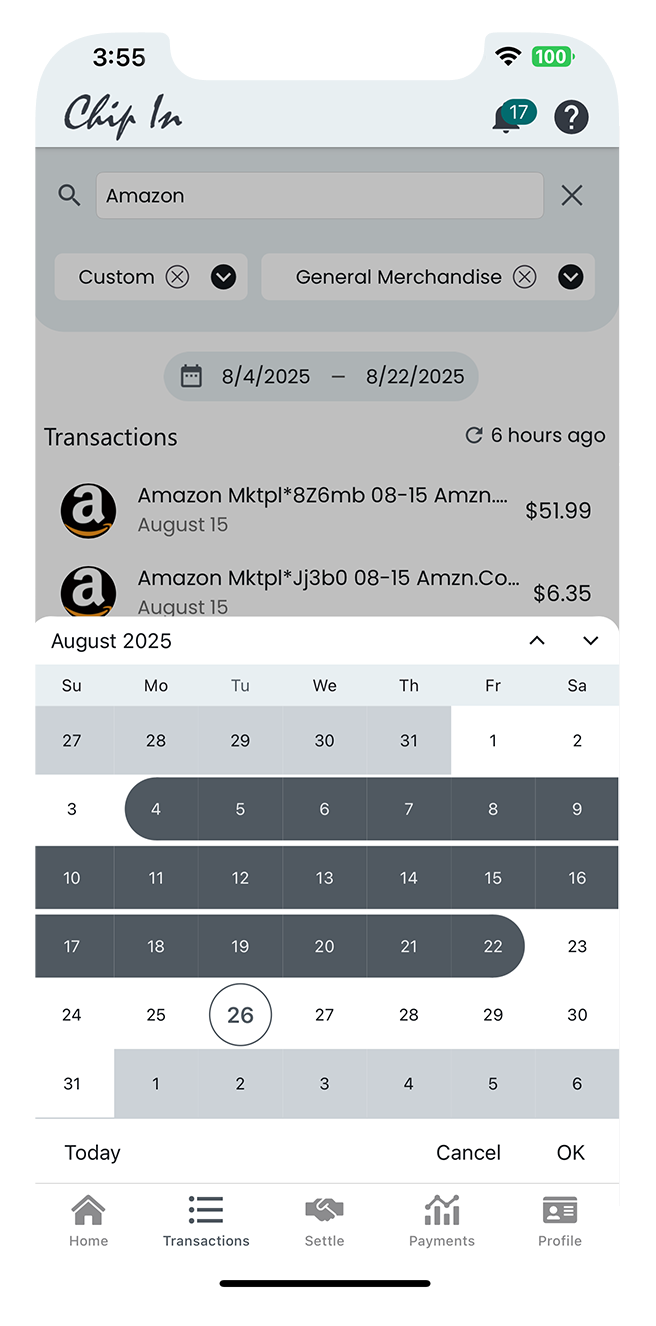

Step 2. Search by Name, Date Range, or Category

Easily search all of your transaction by pre-set date ranges, custom date ranges, contains search, or by categories.

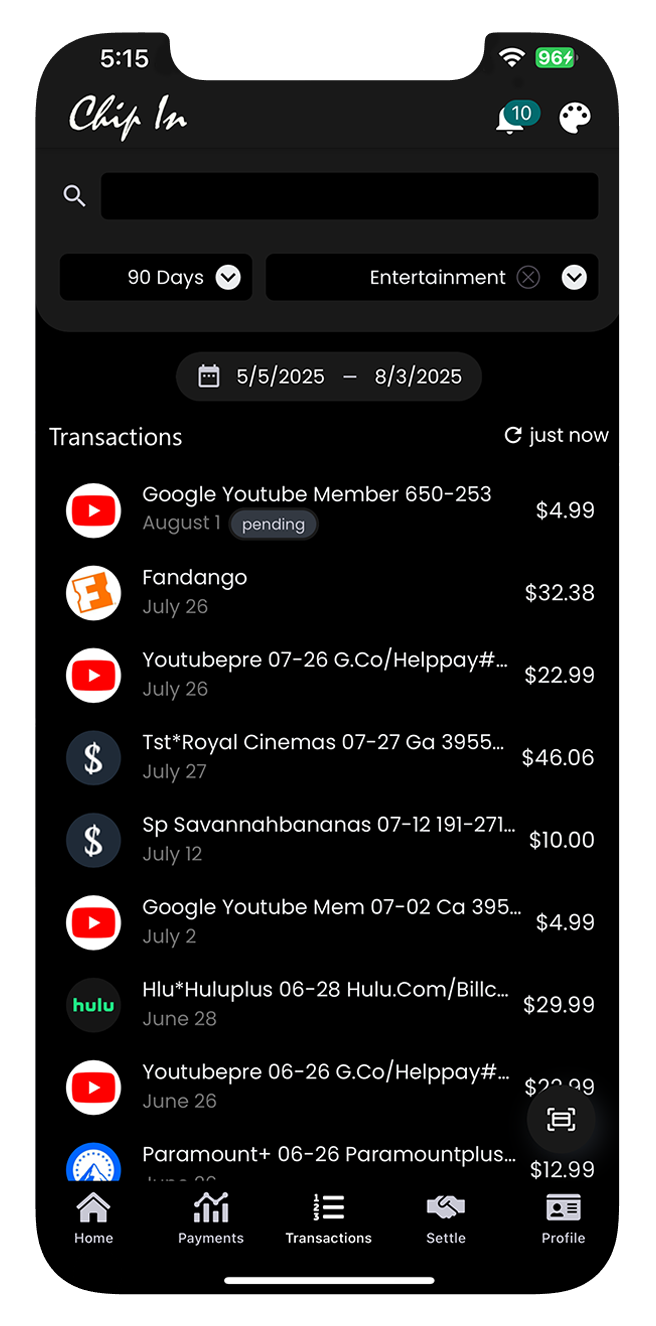

Step 3. Automatic daily sync

Every purchase from your linked bank or card accounts lands in the app each day, courtesy of secure Plaid integration.

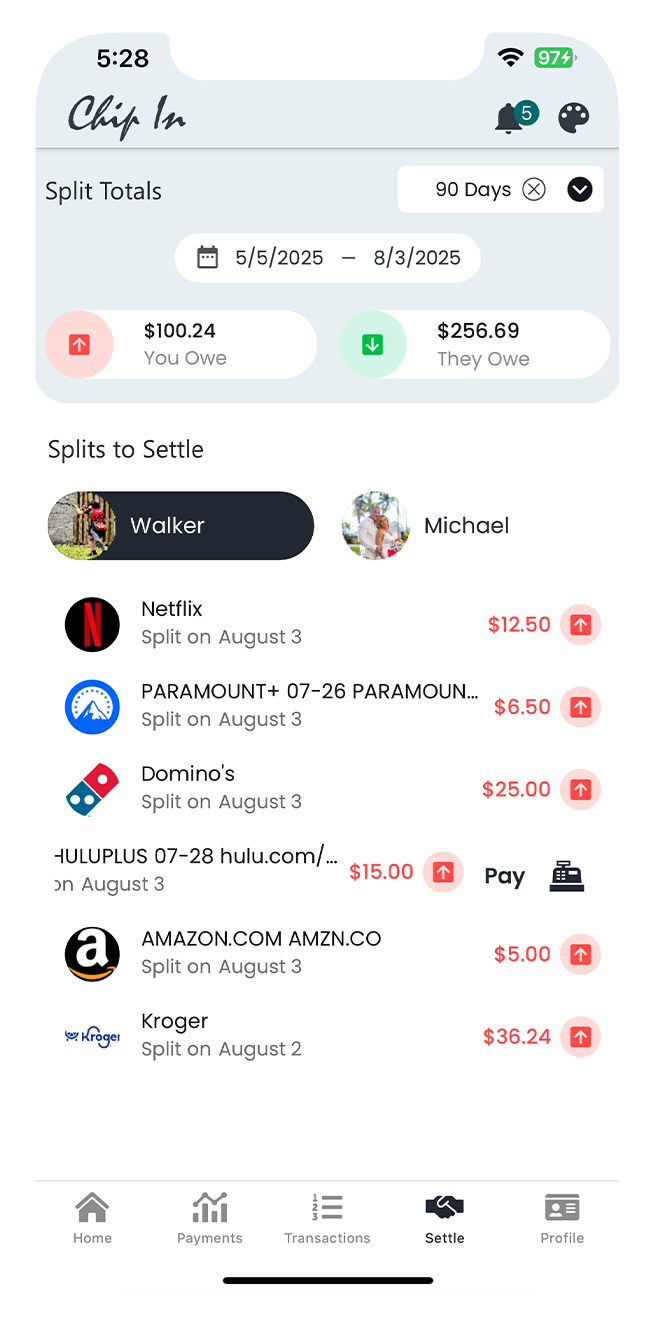

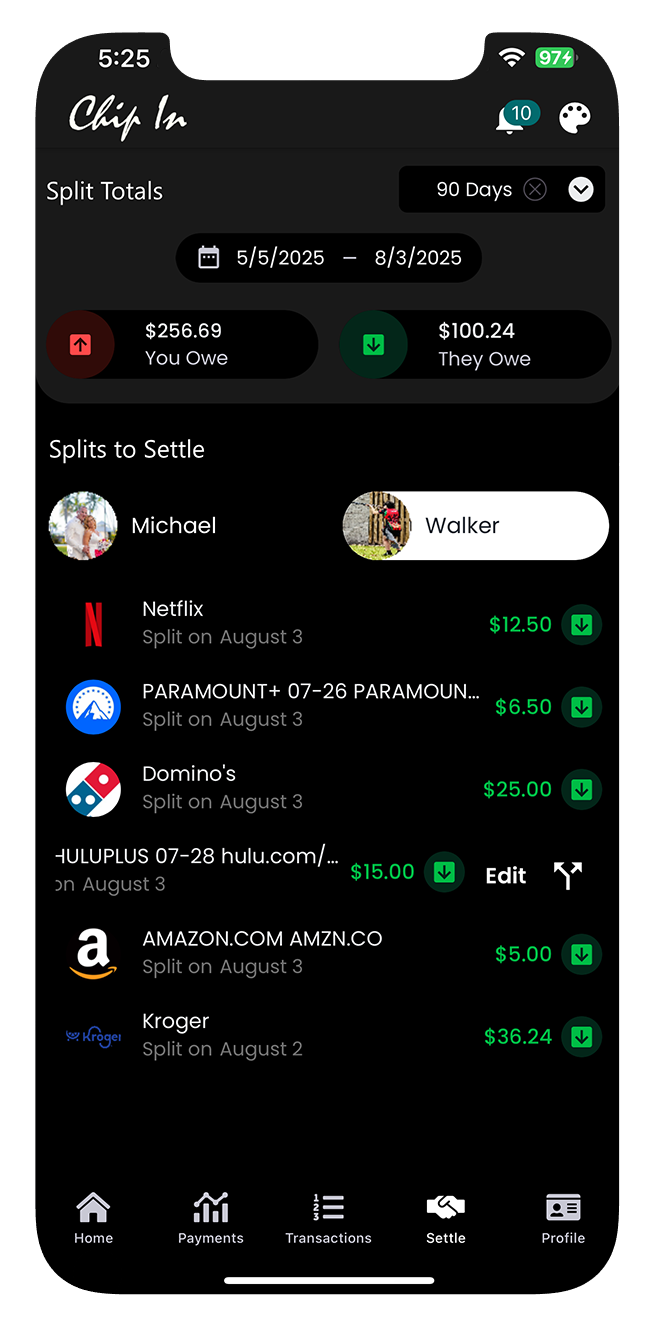

Step 4. Settle splits with ease

Easily see what splits both you and your partner have to settle. Breaking down in a very simple, easy to use, interface your and your partner's totals.

Step 5. Ability to edit splits until paid

You may edit your partners splits with a simple tap, up until your partner has decided to pay. NOTE: Payments can easily be reversed if a mistake has been made with a 'Revert' feature.

Step 6. Flexible peer-to-peer payment options

Pay via Venmo, Cash App, or manual options (e.g., cash, check). Each partner can enter their Venmo/Cash App username in their profile, so payments are seamless (Sends User, Amount, and Notes about the transaction and split for payment tracking).

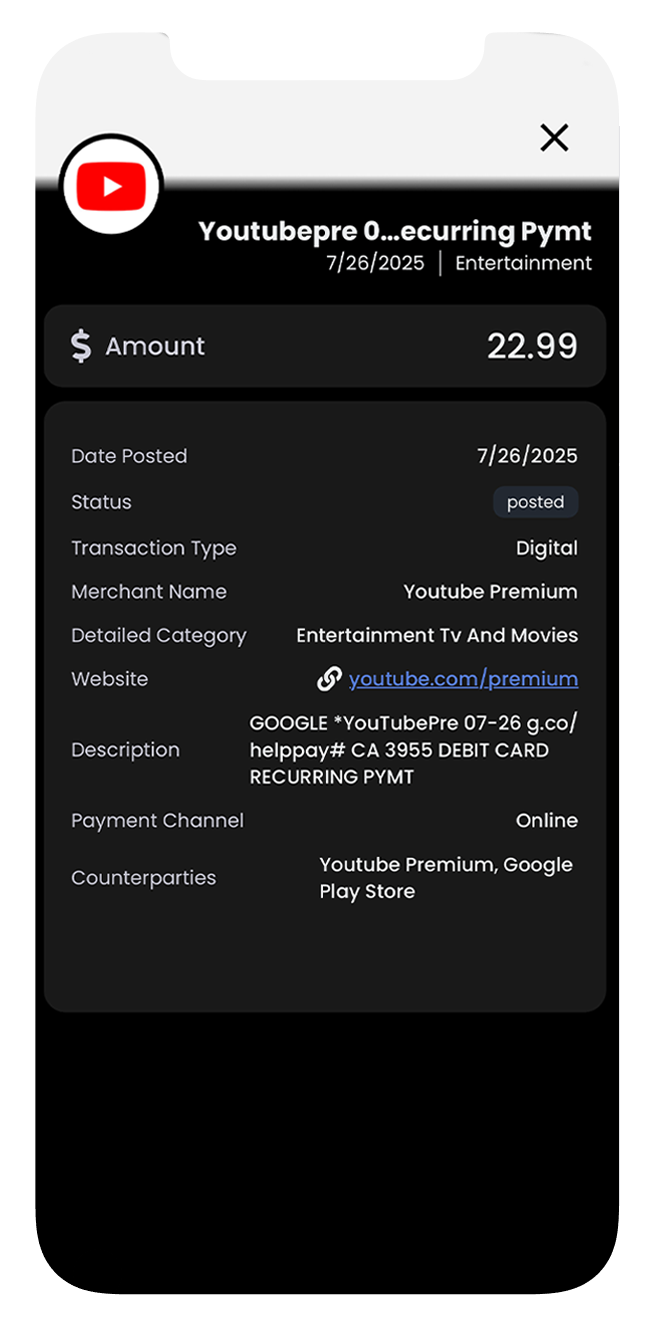

Step 7. Know your institution transaction data

The most comprehensive transaction data available, including merchant details, status, detailed category, website, full description, payment channels, counterparties, location, and more.

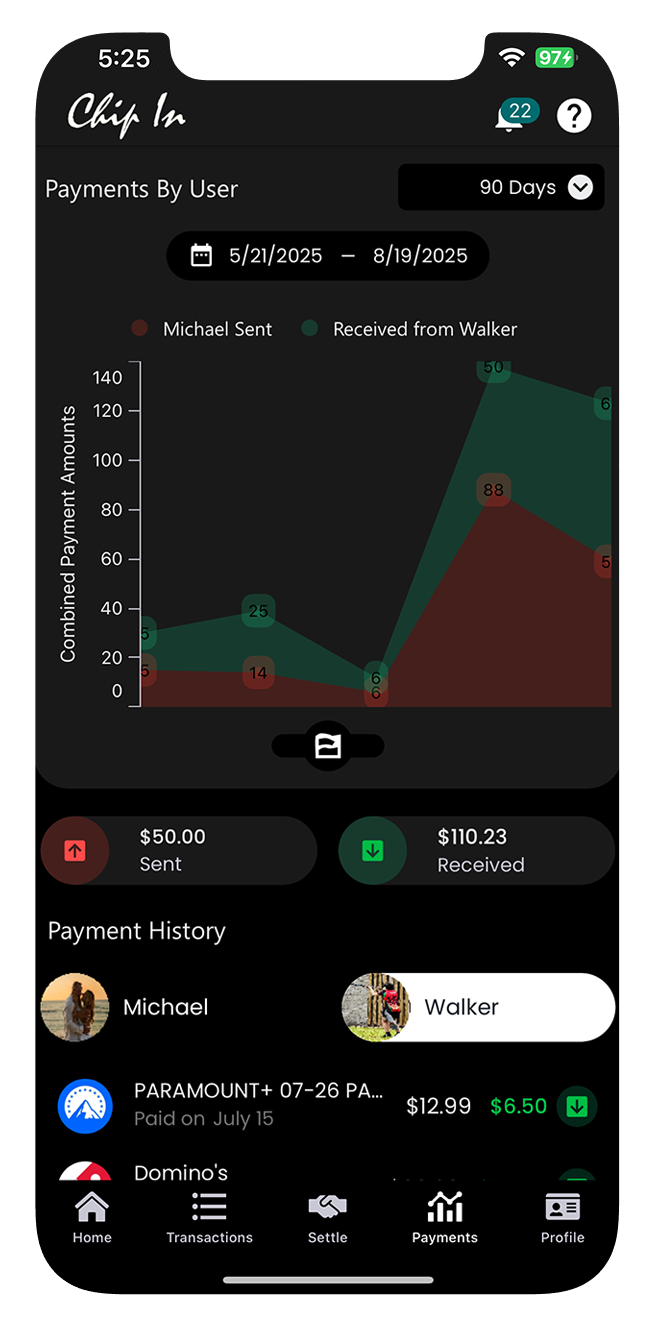

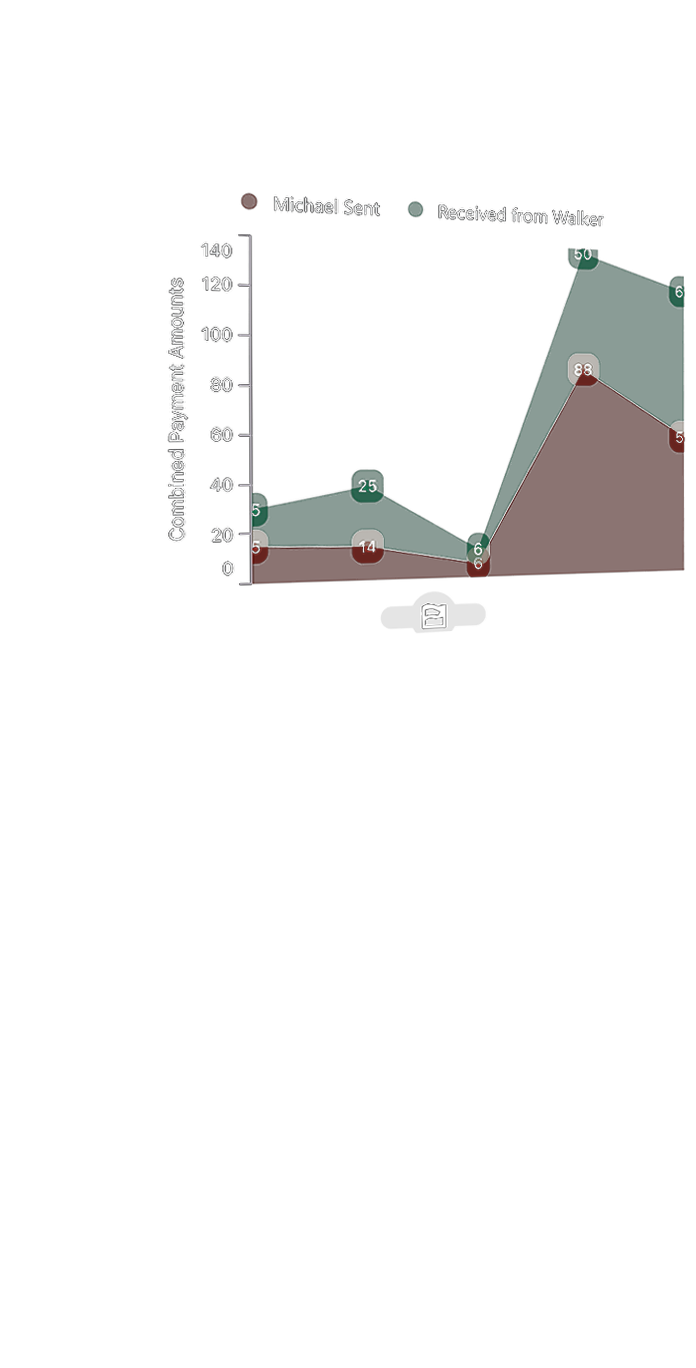

Step 8. Smart **auto-categorization** of spending, with visual breakdowns

Automatically categorize your spending with visual breakdowns, making it easier to understand your financial habits and identify areas for improvement. Payments by category for each partner as well as total payments by user, combined.

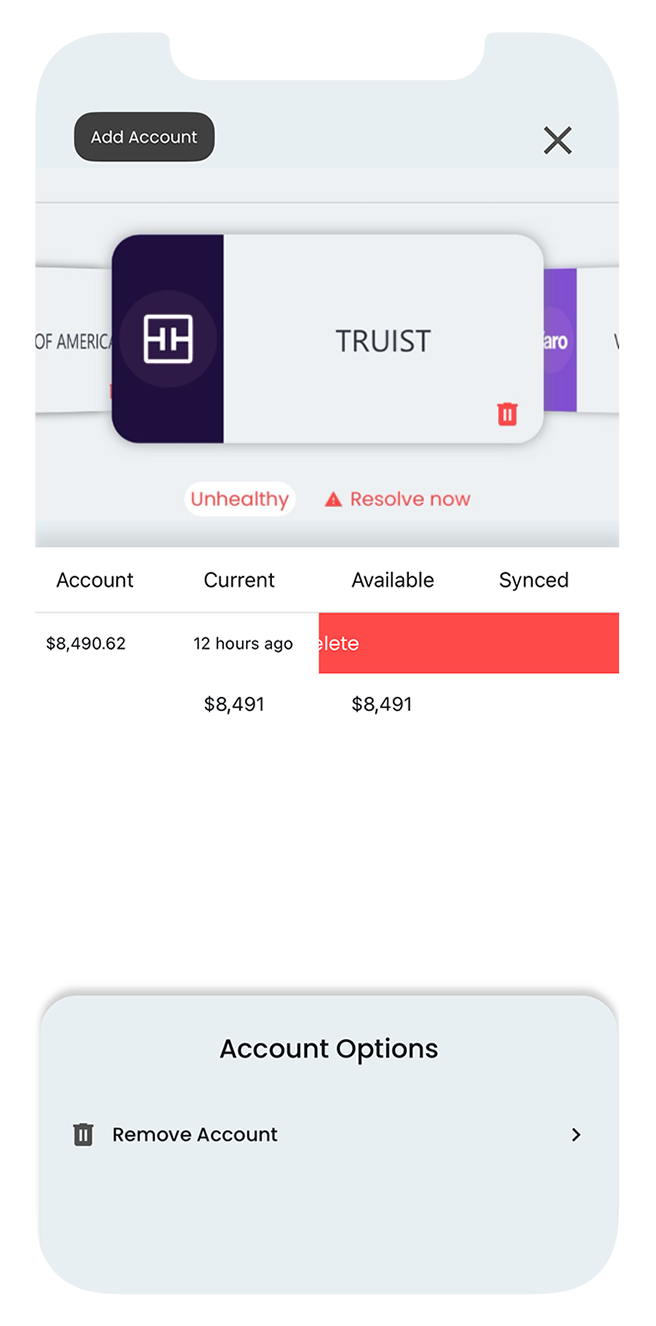

Step 9. Total account control

Add or remove institutions or specific accounts on the fly; Chip In notifies you if re‑authentication is ever needed. We use PLAID, a leading financial technology provider, to ensure you have the most up-to-date, accurate information. Used by leaders in the field such as Rocket Money.

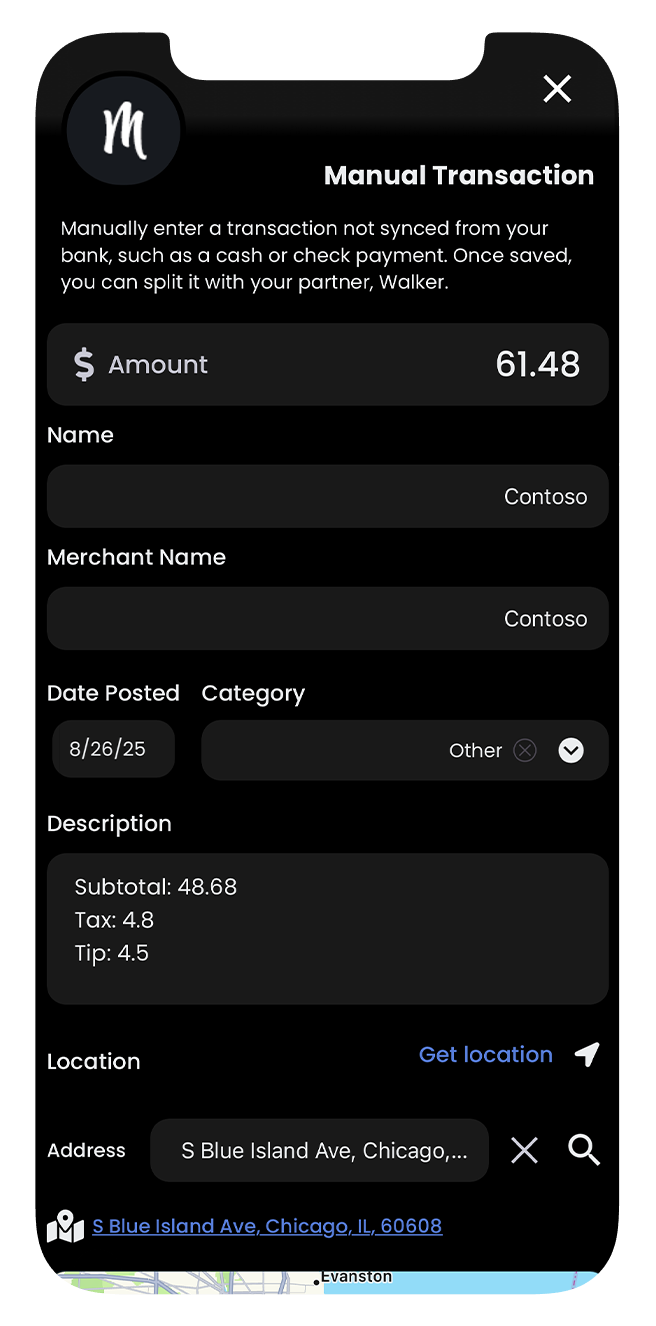

Step 10. Manual entries

Log rent, group dinners, or anything that isn't on a statement, so nothing falls through the cracks. Even mark the location with a tap, which will provide you both a map and directions.

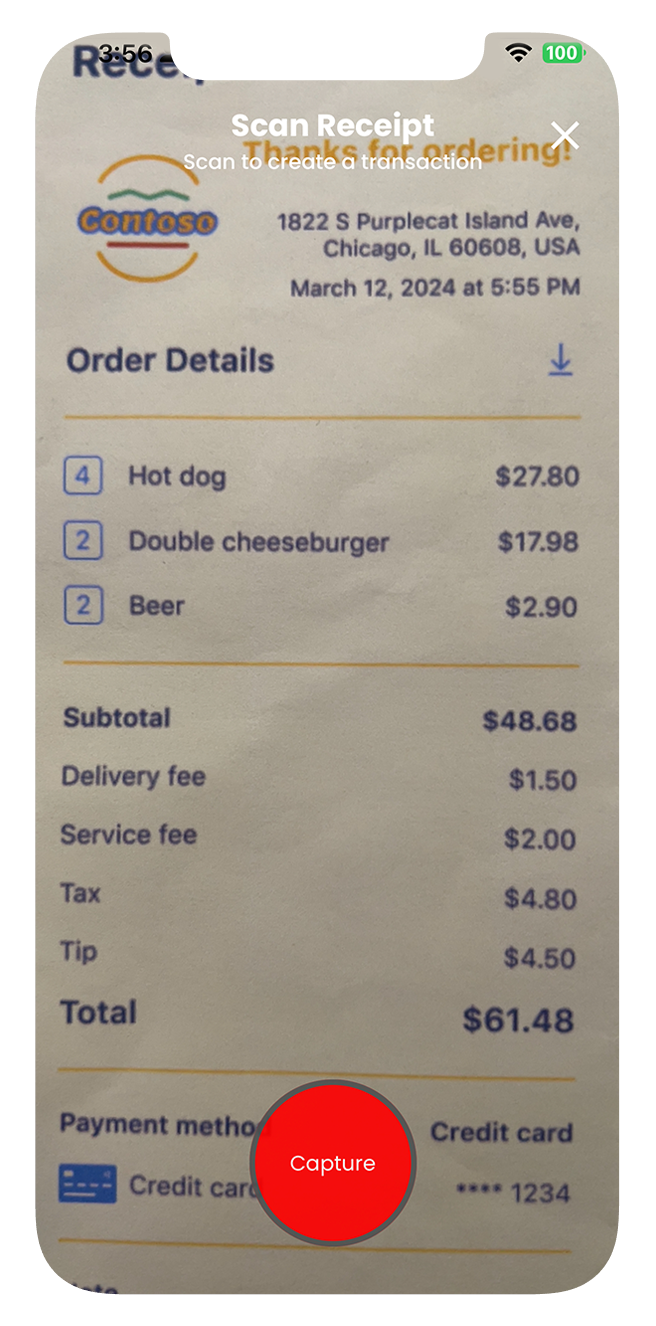

Step 11. Intelligent receipt scanning

Automatically scan and digitize your receipts, making expense tracking effortless. Our advanced AI document intelligence technology from Azure extracts key information, so you can focus on what matters.

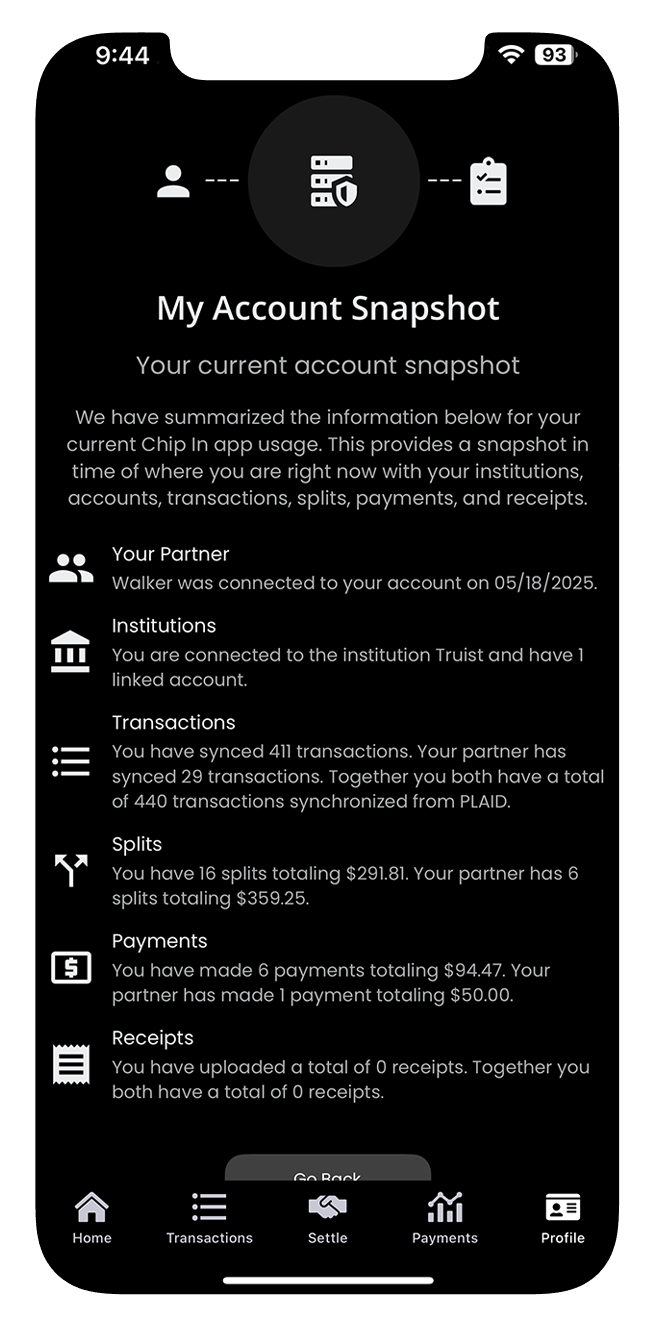

Step 12. Realtime snapshot

Get a real-time snapshot of your financial situation, including current institutions and accounts, and breaking down between both you and your partner synced transactions from PLAID, splits shared together with amounts, payments shared together with amounts and how many receipts you both have snapped. Stay informed and in control of your finances at all times.

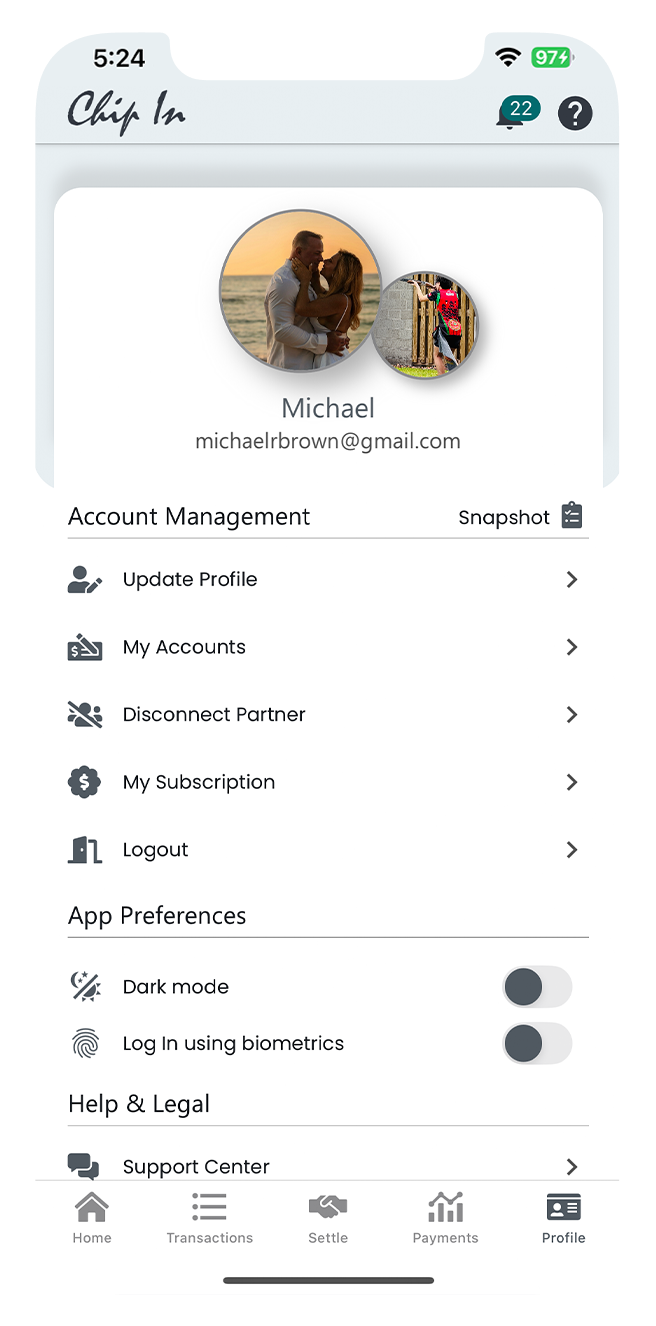

Step 13. Your profile

Upload your picture or avatar to personalize your partnership. Manage your personal information such as your display name (nickname), payment account usernames, and more. Manage your partner (if you're the account holder). View or manage your subscription from Apple or Google. Set dark mode or light mode based on your preference. Turn on biometrics for a more secure log in flow. And view legal services and support, or delete your entire account in-app.

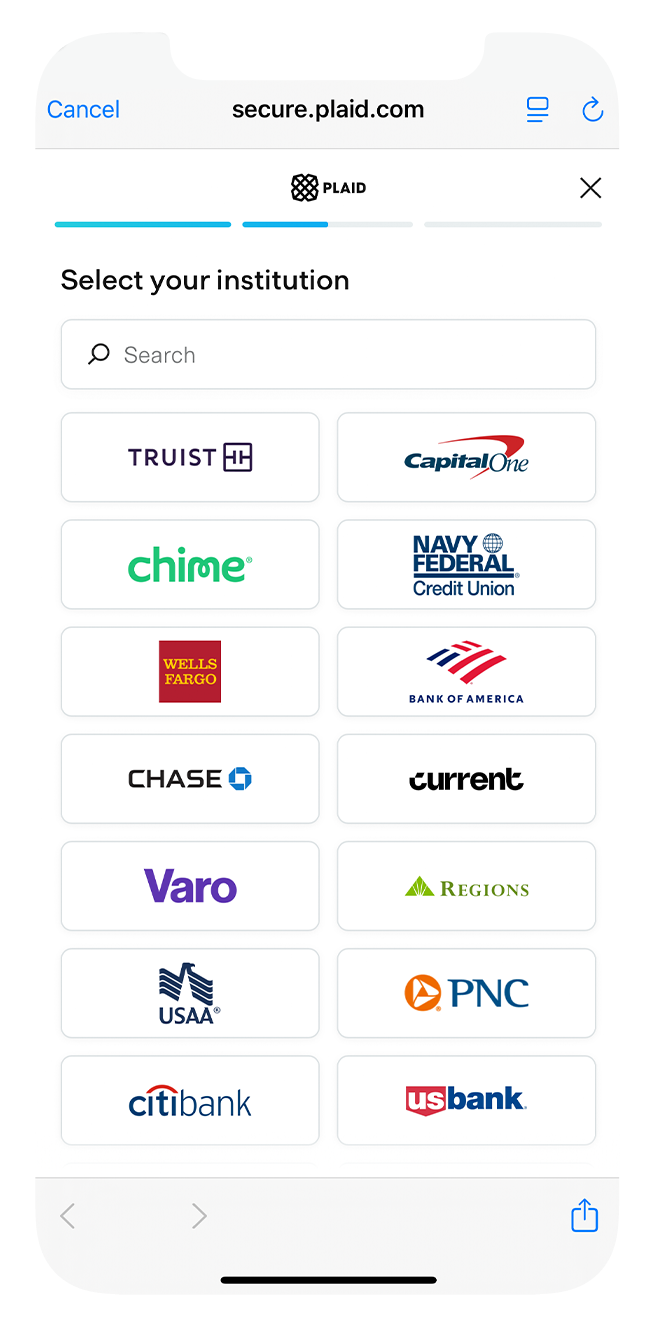

Step 12. PLAID financial integration

Seamlessly connect your bank accounts and financial institutions using PLAID, ensuring secure and accurate data synchronization (accounts are reliably updated and kept up to date often unlike competitors). PLAID offers over 5000+ institutions to connect, offering you the most comprehensive platform within Chip In, all while maintaining the highest standards of security and privacy.

Clients are Loving Our App

Any questions?

Check out the FAQs

Still have unanswered questions and need to get in touch?

Still have questions?

Email us🔒 Our Security Approach

We don't store any authentication information. Instead, we use Google Firebase to completely abstract away your login from your data. Your information is hosted on Azure Cloud with 99.999% uptime, full backups, advanced load balancers, firewalls, network security groups, and private endpoints — all following well-architected cloud standards to keep your data safe, period.

🏦 Bank-Grade Security

- ✅ Zero credential storage

- ✅ One-time password sign-up

- ✅ Encrypted cloud architecture

- ✅ Latest secure protocols

Your data stays locked down and secure — always.

We offer the ability to download your payment history into excel format.

This allows you to slice and dice your payment history, of all time, on your phone or your personal computer.

This is a feature that is currently in development.

Within the next week or two we will offer the ability to not only show recurring transactions, but automate the splitting of them for future dates, notifying your partner when they occur.

Enjoy a 7‑day free trial, then choose an industry‑leading low monthly or annual plan. Cancel anytime right inside the app—no phone calls, no chatbots, no hassle.

Payment will be charged to your Apple ID account at confirmation of purchase. Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period. Account will be charged for renewal within 24-hours prior to the end of the current period. You can manage and cancel your subscriptions by going to your Account Settings on the App Store after purchase. Any unused portion of a free trial period, if offered, will be forfeited when you purchase a subscription.

Invite your partner in seconds and start sharing only the transactions you choose; your individual accounts stay completely siloed.

In your profile area, tap Connect Partner. A dialog will appear with instructions.

- An SMS will be sent to your partner from your phone. The message is pre-filled.

- Enter your partner’s mobile number and tap Send.

- Your partner will receive the text. Their first step should be to download the Chip In app — but they should not open it or sign up yet.

- When they tap the link in the text, it will open the Chip In website. They should tap Allow.

-

The app will open automatically. Your partner will:

- Verify their email address

- Create a display name (nickname)

- Set a password

That’s it. They’ll be instantly connected to you in the app.

We felt the market is saturated with many financial management apps, especially apps that focus on splitting between many people, but none focus on the unique needs of couples managing shared expenses.

By focusing on just two people, we can create a more tailored experience that addresses the specific challenges and dynamics of managing shared finances in a relationship. We believe this approach fosters better communication and collaboration between partners. It also keeps things simple, allowing couples to easily track and manage their shared expenses without the complexity of involving multiple parties.